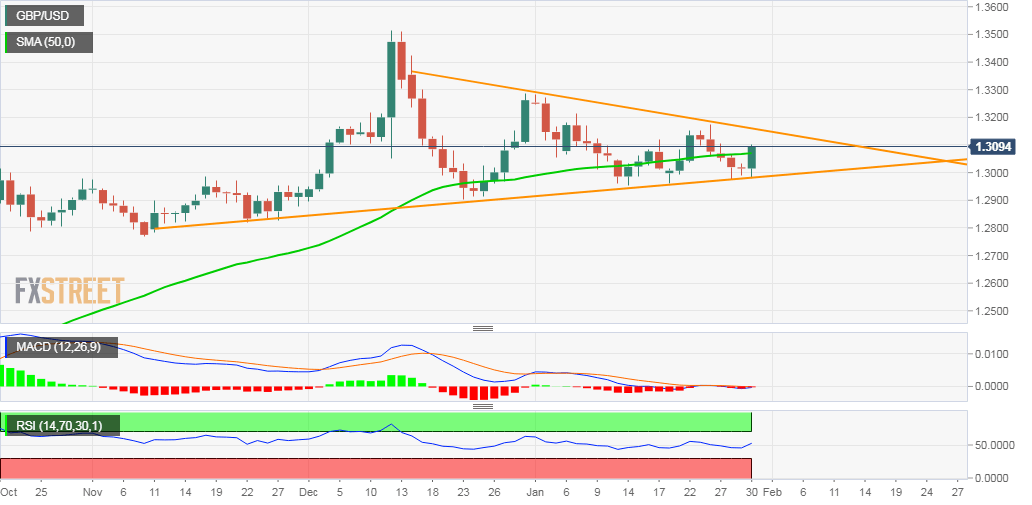

GBP/USD Price Analysis: Bulls looking to extend the post-BoE positive move beyond 1.3100 mark

- GBP/USD rebounds sharply from 2-1/2-month-old ascending trend-line.

- The upside is likely to remain capped by another descending trend-line.

The GBP/USD pair staged a solid intraday recovery from closer to weekly lows and support marked by 2-1/2 month-old ascending trend-line. The positive momentum got an additional boost, lifting the pair to the 1.3100 neighbourhood following a relatively hawkish BoE policy decision.

Technical indicators on 4-hourly/daily charts have now moved back into the positive territory. However, oscillators on the 1-hourly chart are already flashing slightly overbought conditions and hence, any subsequent positive move might stall near the 1.3135 horizontal resistance zone.

Some follow-through buying might lift the pair further towards last week's swing high, around the 1.3170 region. The latter coincides with a near two-week-old descending trend-line resistance and cap additional gains ahead of the UK's exit from the European Union on Friday.

On the flip side, immediate support is now pegged near the 1.3050-45 region, below which the pair is likely to slide back towards challenging the mentioned trend-line support. A convincing break through might be seen as a key trigger for bearish traders and open the room for a further downfall.

GBP/USD daily chart