Back

27 Feb 2020

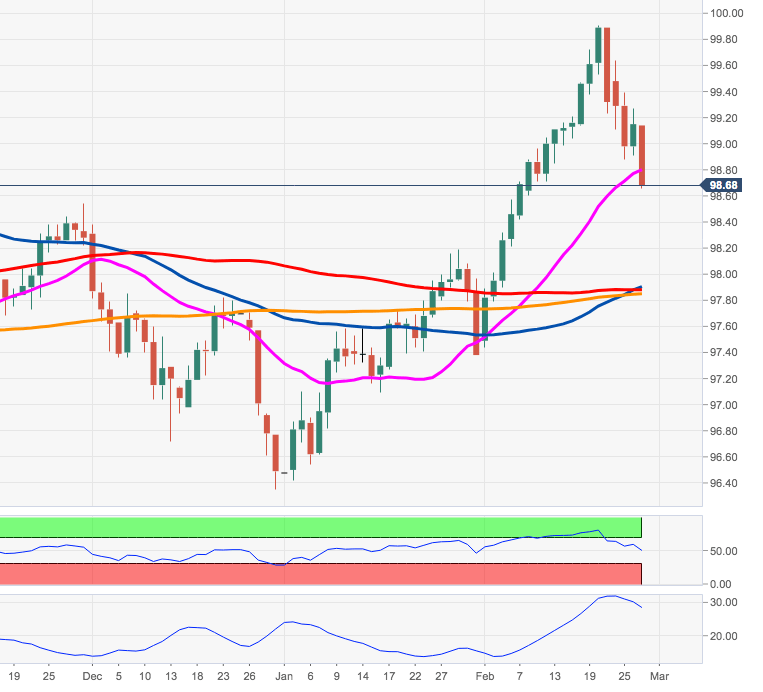

US Dollar Index Price Analysis: Leg lower seen testing 98.50

- DXY is extending the correction lower to the 98.70/65 band so far.

- The next contention area emerges in the mid-98.00s.

DXY remains cautious amidst the prevailing risk-off context in the global markets. The dollar has come under renewed downside pressure and breaks below the 99.00 support.

The continuation of the correction lower could re-visit the 98.58/54 area, where coincide the November 2019 high and a Fibo retracement of the 2020 rally.

While above the 200-day SMA, today at 97.83, the outlook on the greenback is seen as positive.

DXY daiy chart